Irs vehicle depreciation calculator

Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. Supports Qualified property vehicle maximums 100 bonus safe harbor rules.

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl

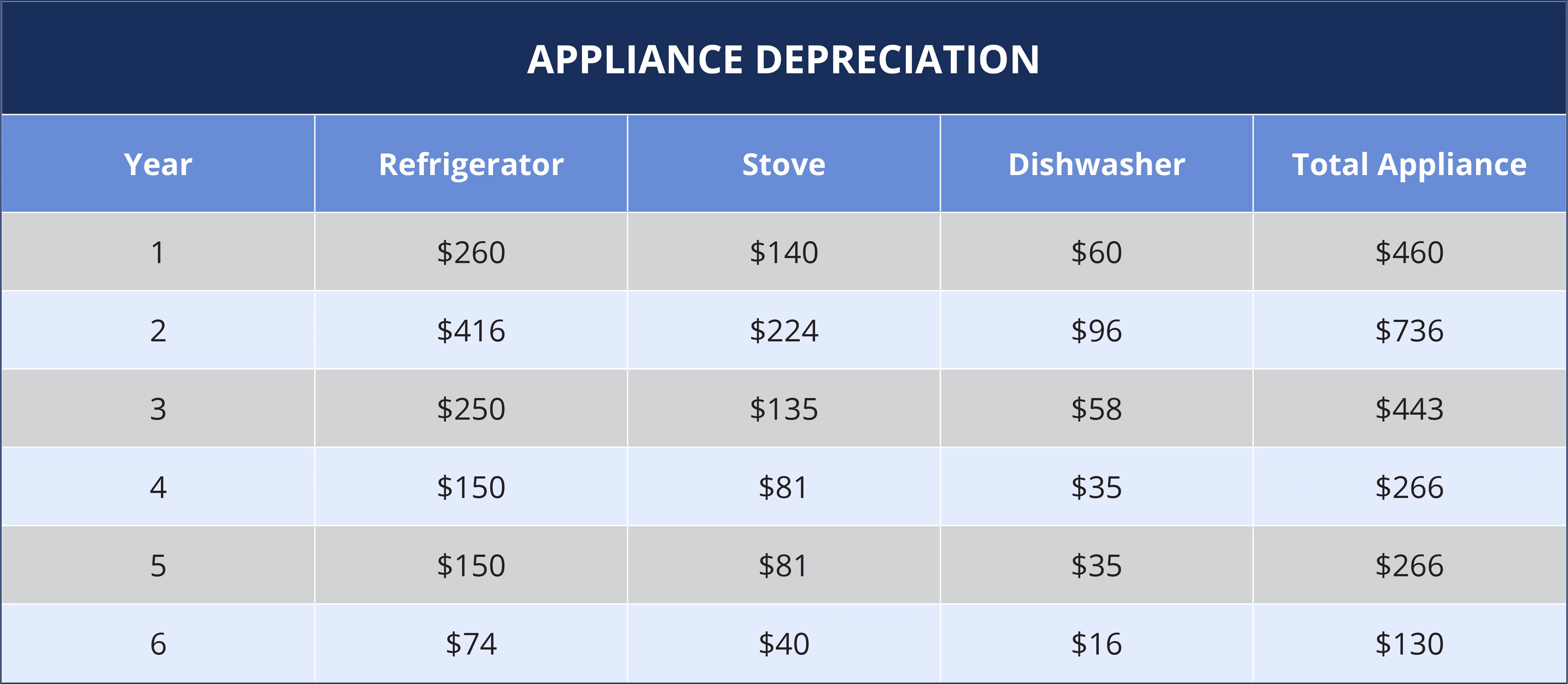

This calculator will calculate the rate and expense amount for personal or real property for a given.

. Schedule C Form 1040 Profit or Loss From. Select the currency from the drop-down list optional Enter the. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime.

The IRS issued its annual inflation-adjusted update of depreciation limitations for passenger automobiles including passenger vans and trucks placed in service in 2021 Rev. Alternatively if you use the actual cost method you may take deductions for. Depreciation of most cars based on ATO estimates of useful life is.

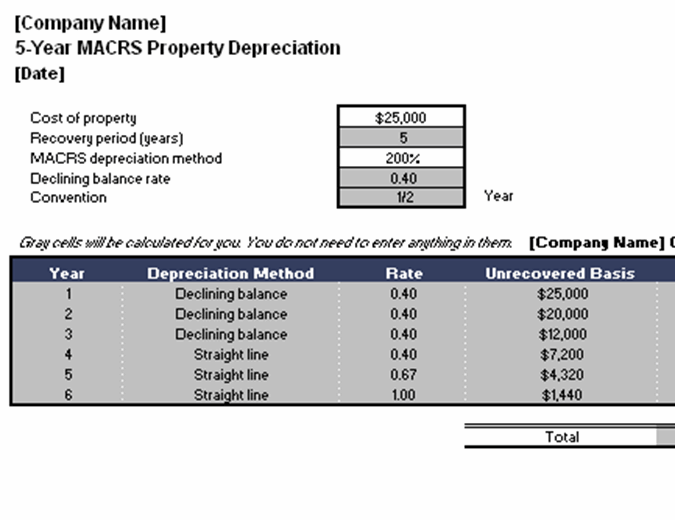

Depreciation limits on business vehicles. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation.

The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices. If you use this method you need to figure depreciation for the vehicle. The MACRS Depreciation Calculator uses the following basic formula.

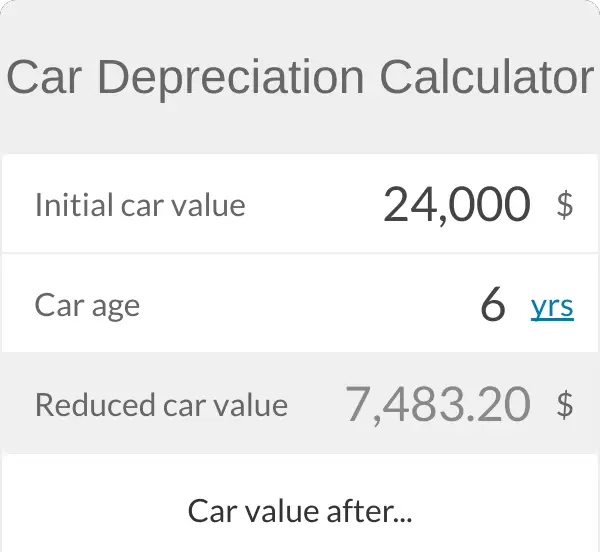

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. D i C R i. The calculator also estimates the first year and the total vehicle depreciation.

If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later. Example Calculation Using the Section 179 Calculator. Free MACRS depreciation calculator with schedules.

You can claim business use of an automobile on. The IRS has announced the 2022 inflation-adjusted Code 280F luxury automobile limits on certain deductions that may be taken by taxpayers using passenger. Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle.

In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the. We base our estimate on the first 3 year. 510 Business Use of Car.

It is fairly simple to use. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you. Car Depreciation Calculator.

For instance a widget-making machine is said to depreciate. Where Di is the depreciation in year i. All you need to do is.

Gas repairs oil insurance registration and of course. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business.

Adheres to IRS Pub. C is the original purchase price or basis of an asset.

Rental Property Depreciation Calculator Outlet 54 Off Www Ingeniovirtual Com

Rental Property Depreciation Calculator Outlet 54 Off Www Ingeniovirtual Com

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Kqcexxsvqgcwsm

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions

Accounting For Rental Property Spreadsheet Income Statement Statement Template Profit And Loss Statement

1 Free Straight Line Depreciation Calculator Embroker

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Definition

How To Calculate Depreciation Of A Car Carproclub Com

Section 179 Deduction Hondru Ford Of Manheim

4 Tax Tips For Small Business Owners Tips Taxes Taxtime Income Tax Tips Tax Return Tips Business Small Business Tax Small Business

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Bookkeeping Small Business Tax Small Business Accounting

Rental Property Depreciation Calculator Online 55 Off Www Quadrantkindercentra Nl