Irs w4 estimator

Or keep the same amount. You must understand the.

Form W 2 Vs W 4 What S The Difference By Sagenext

This Tax Return and Refund Estimator is currently based on 2022 tax tables.

. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Use the PAYucator or W-4 Check tool below and at the end of the paycheck calculator in section. The purpose of Tax Form W-4 is simple it is used by your employer to withhold the proper amount of federal income tax from your paycheck.

Your W-4 can either increase or decrease your take home pay. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime.

Enter your new tax withholding amount on. The W-4 Pro Calculator is the most advanced and accurate planning tool to optimize your W-4s as it is based on your estimated or actual 2021 or estimated 2022 2023 tax return. Determine if they should complete a new Form W-4.

The information you give your employer on Form. Figure out which withholdings work best. Start the TAXstimator Then select your IRS Tax Return Filing Status.

Know what information to put on a new Form W-4. The Tax Withholding Estimator uses your filing status income adjustments deductions and credits to estimate your anticipated tax obligation. If you have an expected refund you can move the toggle to the left.

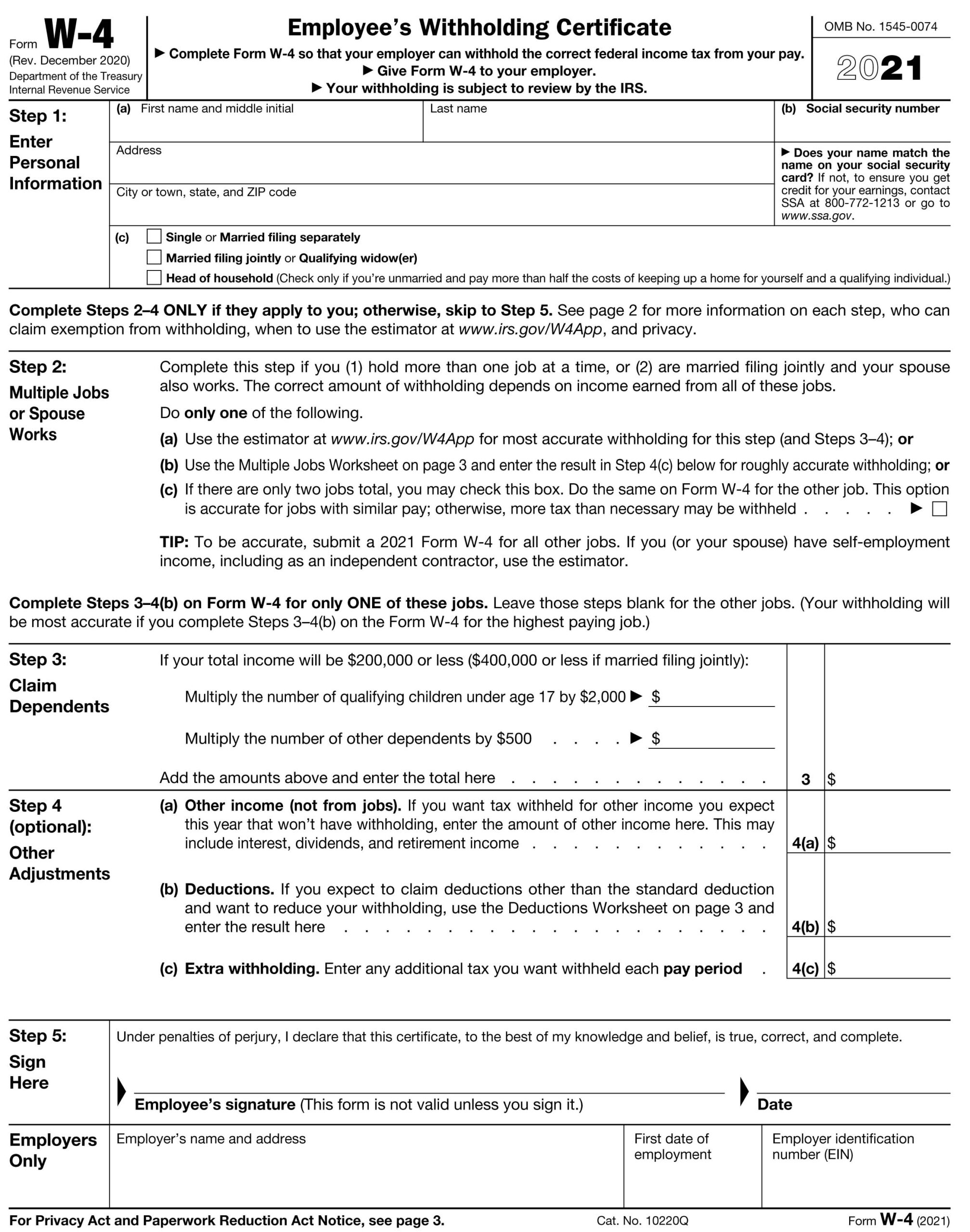

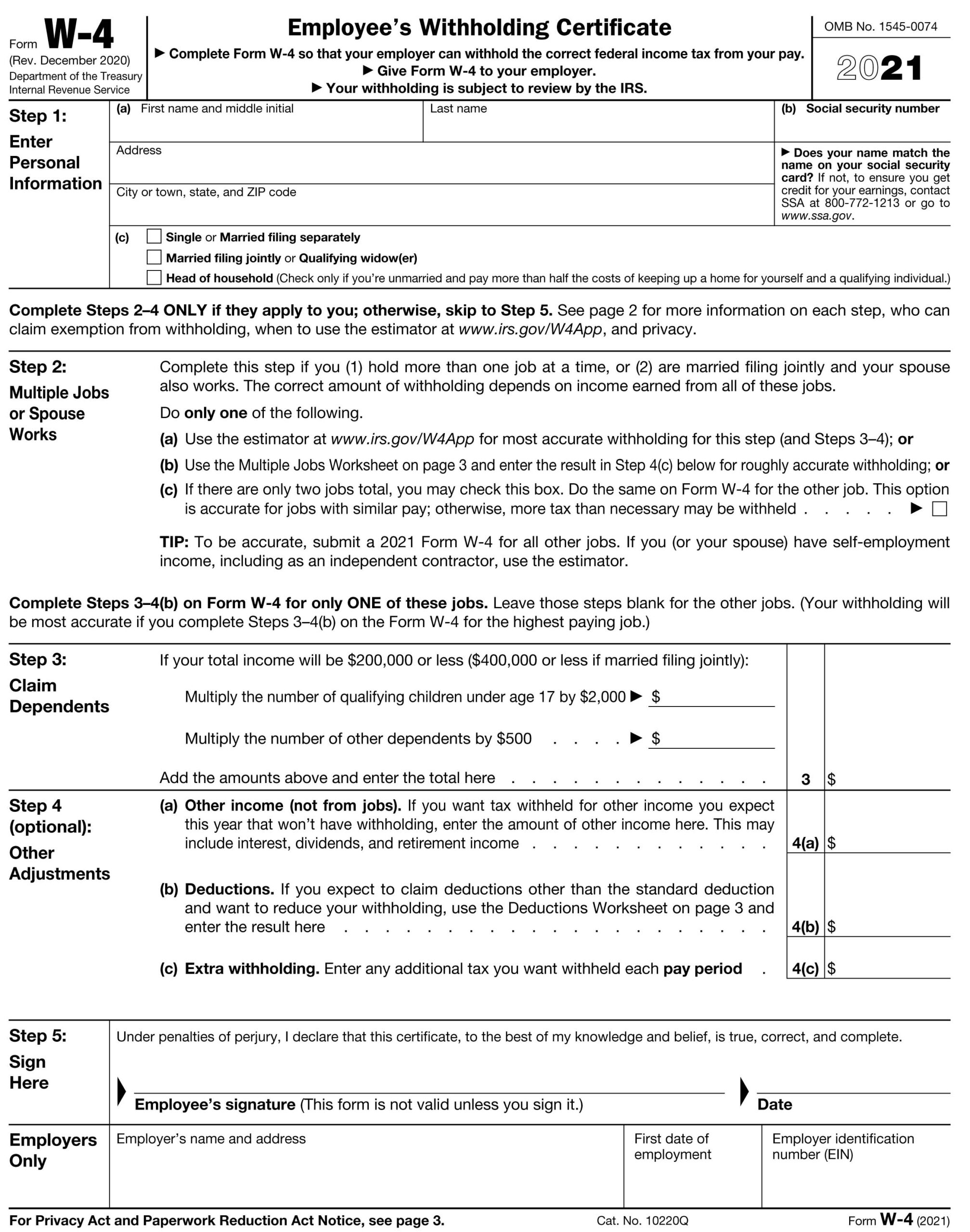

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Your withholding is subject to review by the IRS. IRS Form W-4 is completed and submitted to your employer so they know how much tax to withhold from your pay.

Prepare and e-File your. The IRS W-4 calculator assists you in determining the suggested withholding amount as well as any additional withholding that should be reported on your W-4 form. The tool will provide next steps to reduce your paycheck tax.

The amount you earn. 1545-0074 2022 Step 1. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Use your estimate to change your tax withholding amount on Form W-4. To change your tax withholding amount. See the calculators results.

Your actual tax obligation. Enter Personal Information a First name and middle initial Last name Address City or town state and ZIP. The amount of income tax your employer withholds from your regular pay depends on two things.

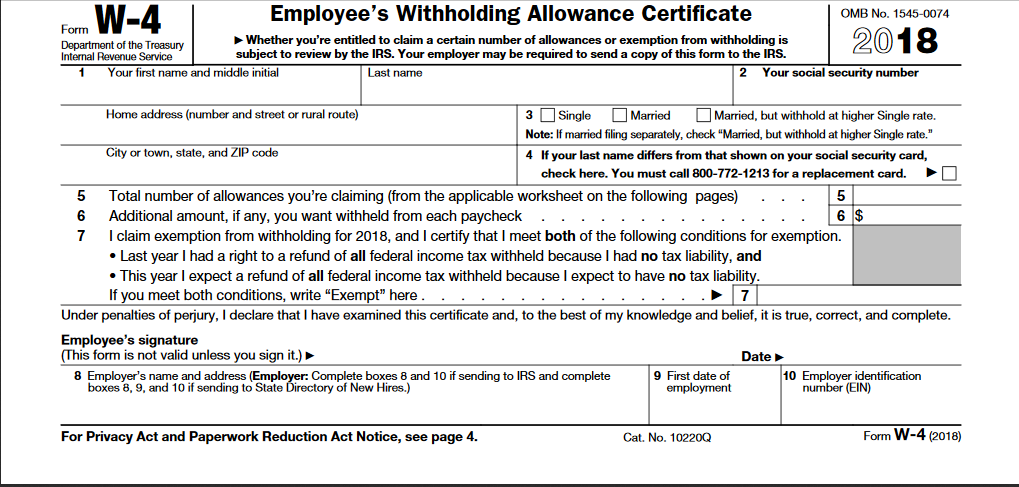

The Withholding Calculator asks taxpayers to estimate their 2018 income and other items that affect their taxes including the number of children claimed for the Child Tax. If you are employed and the Tax Withholding Estimator indicates you will have too much tax withheld you may have your federal withholding decreased by preparing a new Form. Use our W-4 calculator.

The IRS recommends that employees. The IRS Tax Withholding Estimator can help taxpayers. Step 6 - Results.

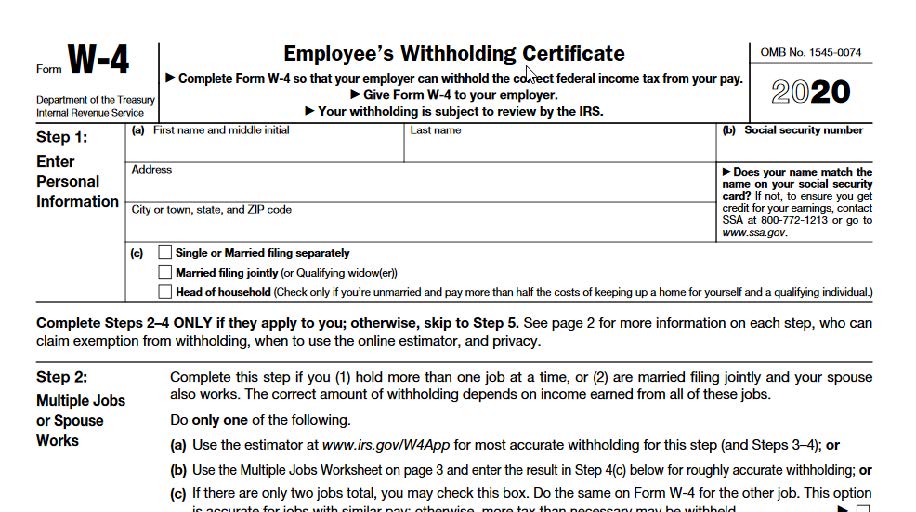

E Alert Irs Issues 2020 Form W 4 Hr Knowledge

How To Use The Irs Withholding Tax Estimator For Form W 4 Youtube

What Is Irs Form W 4

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Much M Online Taxes Tax Refund Irs Taxes

How To Use The Irs Withholding Tax Estimator For Form W 4 Youtube

The New Irs Form W 4 Has Many Scratching Their Heads Here S What You Should Know Komo

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

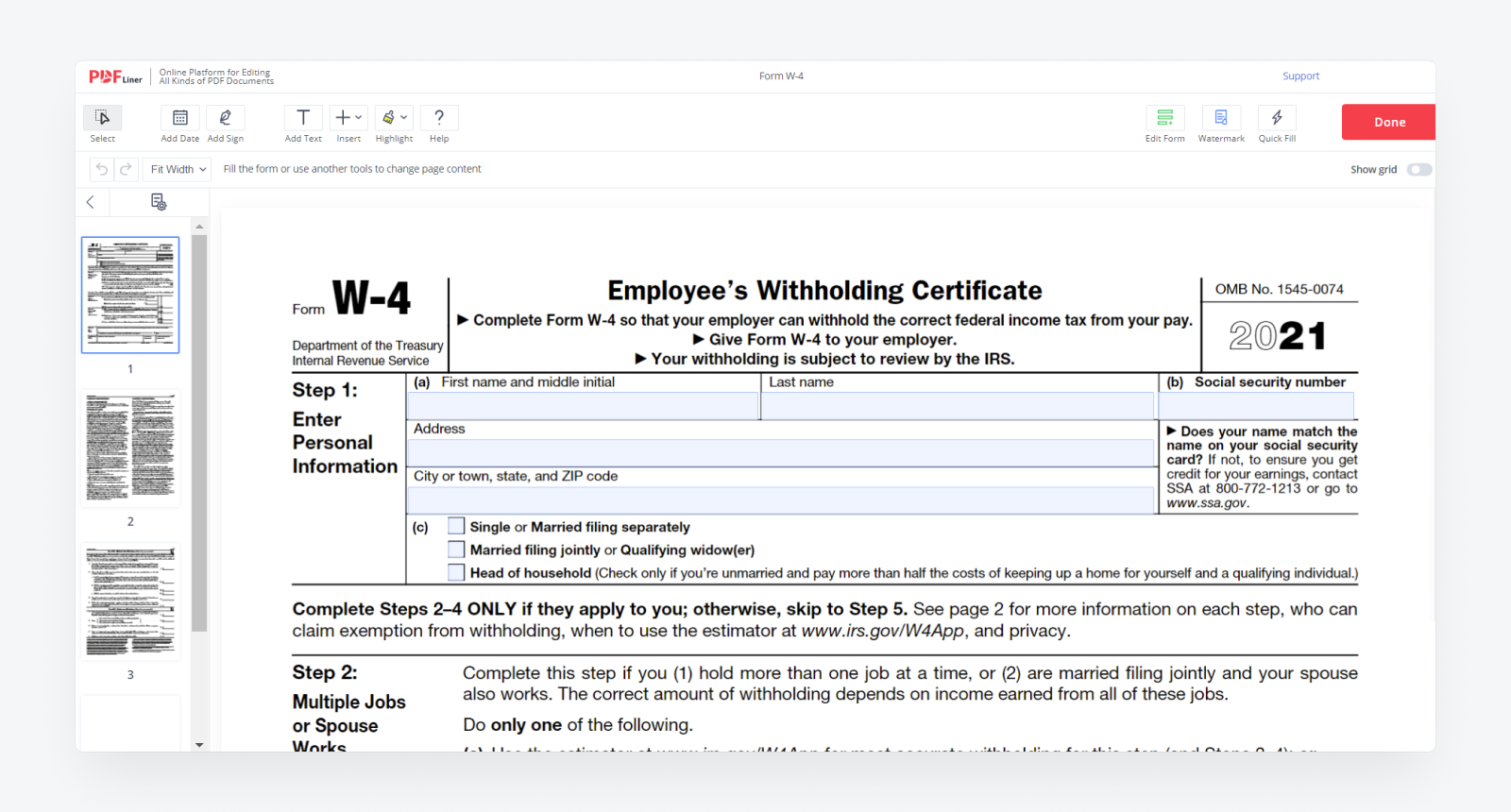

How To Fill Out 2021 2022 Irs Form W 4 Pdf Expert

Irs Releases An Early Draft Of The 2020 W 4 Erp Software Blog

Irs Releases New 2018 W 4 Form

Tax Forms Easy Tax Store

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

W 4 Form Basics Changes How To Fill One Out

How To Fill Out Irs Form W 4 2020 Married Filing Jointly

Irs Improves Online Tax Withholding Calculator

Tax Withholding Estimator New Free 2019 2020 Irs Youtube

How To Get A W 4 Form And Which Steps To Take